The two main ways that investing in stocks may generate returns are through dividend income and capital appreciation. It is essential for people who want to use the stock market to gain wealth and reach their financial objectives understand these mechanisms.

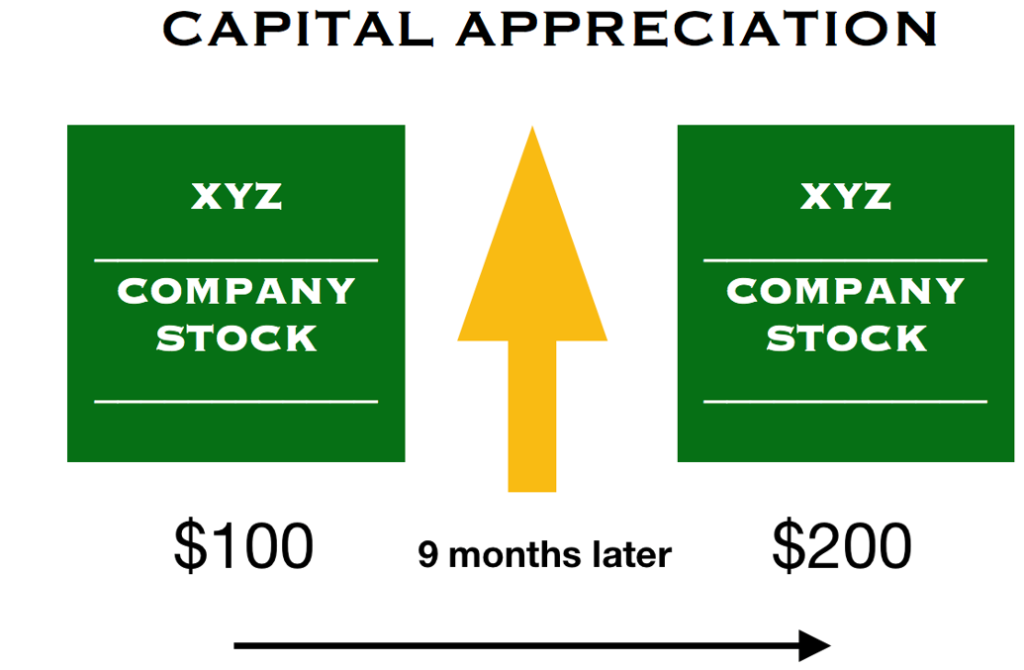

Capital Appreciation

Probably the most popular strategy for stock investors to profit from their investments is capital appreciation. It is purchasing firm stock at a specific price and then selling it for a higher amount in order to make a profit. Simple math tells us to purchase low and sell high. However, an in-depth review of industry trends, business fundamentals, and general economic circumstances is necessary to carry out this plan successfully.

Numerous factors, such as business performance, market trends, macroeconomic indicators, investor mood, and geopolitical developments, affect stock prices. Capital appreciation is possible for investors who anticipate these factors and correctly forecast future market changes. An investor may, for example, choose to buy shares of a firm with promising growth prospects, a cheap stock price, or a competitive edge in its industry, all with the hope that the stock price will rise in the future.

Although capital appreciation carries some risk, it also has the potential to yield large rewards. Stock prices are subject to sudden changes in response to unexpected events and changes in the market. If the stock price drops after being purchased, investors can lose money.

Dividend Income

Another method stock investments can benefit investors is through dividend income. A percentage of a company’s profits that is routinely, usually quarterly or annually, distributed to shareholders is known as a dividend. Businesses that distribute dividends frequently have a history of consistent cash flow and success. Dividend-paying stocks are well-liked by revenue-seeking investors who are looking for dependable passive income streams.

Regardless of how much the stock price rises or falls, dividend income gives investors a consistent flow of cash. Retirees and conservative investors searching for income-producing assets to augment retirement savings or pay living expenses may find this very attractive. Additionally, because dividends are used to buy more shares, which increases future dividend payments, reinvesting dividends can speed up wealth growth through the force of compounding.

It’s important to remember that dividend payments are not guaranteed and that not all equities pay them. Dividend payments may be halted or reduced by companies during hard times or recessions. Therefore, before purchasing dividend-paying stocks, investors should evaluate the sustainability of dividends by looking at things like dividend payment ratios, free cash flow, and dividend history.

Conclusion

In conclusion, dividend income and capital growth are two ways that stock investments can provide profits for investors. Purchasing stocks at a discount and selling them for a higher price is known as capital appreciation, whereas dividend income is obtained by a company’s consistent distribution of its profits to its shareholders. Both methods have advantages and disadvantages, and effective investing necessitates carefully weighing each investor’s financial objectives, tolerance for risk, and market conditions. Through smart investing and portfolio diversification, investors can use the long-term wealth-building potential of the stock market.

#How to make money #make money from stocks #2 ways to make money from stocks